Precisely what is a Business Auto Bank loan? How you can Finance Corporation Vehicles A business auto bank loan is really a variety of secured mortgage that corporations or personal entrepreneurs can use to purchase motor vehicles for company uses. It might be cheaper than an unsecured financial loan, and its fascination expenses could be tax-deductible.

“Using a reverse property finance loan to faucet house equity is Just about the most highly effective choices accessible to retirees now”

Throughout the application approach for an online personal personal loan, borrowers commonly require to provide documents for instance proof of identity, money verification, and in some cases bank statements.

Online loans can have more quickly approval processes, and funds might be disbursed speedier, occasionally in a day as well as hours right after approval. As online lenders obtain information digitally, your data may be more effectively enter and processed into underwriting models.

After you’re searching close to for a private mortgage, there are many elements to check to make sure you find the proper one particular on your circumstance: Interest fee: Own mortgage charges vary from lower than seven% to as high as 36%, no less than for your lenders on our checklist.

The best personal loan to obtain online relies on your credit score score and various elements. Various lenders offer loans to borrowers with poor credit, making it simple to get approved. For example, Upstart has no minimum amount credit history score, which implies a nasty credit rating score doesn’t necessarily have to hold you back again.

? Our A.I. Algorithm has calculated your odds to get a offer you right now in a Remarkable ... 0% You should offer the last four digits of your respective SSN: There's a good probability We now have your file inside our lending community.

Charges on personal loans differ considerably by credit rating and loan more info time period. If you're interested by what type of individual mortgage prices you might qualify for, you can use an online tool like Credible to match options from different private lenders.

Repayment phrases: Personalized mortgage repayment conditions range from one particular calendar year to seven yrs, normally. The extended the repayment expression, the lower the regular monthly payment, but the higher the general desire Value. Terms range by lender.

We comprehensively reality-Examine and overview all information for accuracy. We goal to generate corrections on any mistakes the moment we are aware about them.

An introductory provide could make your buys desire-free of charge for anywhere from six months to two several years. Provided that you can repay the equilibrium in that point, you received’t pay any interest, making it less costly than a private personal loan.

Financial debt consolidation and credit card refinancing entail employing a new mortgage to repay your present harmony. This does not remove personal debt, but replaces a person credit card debt with An additional. Even though personal bank loan fees usually are decreased than credit card curiosity fees, you could possibly pay back more in origination charges and curiosity above the lifetime of the personal loan depending on other mortgage terms. Make sure you talk to a fiscal advisor to find out if refinancing or consolidating is good for you.

You might help maintain points relocating along by examining your to-do checklist and making sure you have got submitted all of the paperwork and information asked for.

At Upstart, our product considers other things for example your education and learning⁴ and employment In combination with your monetary history. It is vital to keep in mind that while you might qualify for a personal mortgage with low credit, your mortgage could have better fascination costs.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Spencer Elden Then & Now!

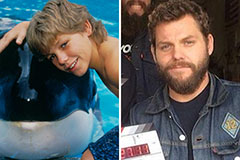

Spencer Elden Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now!